The Fintech Invasion: Is Your Web3 Organization Ready for Mainstream Competition?

Sep 5, 2025

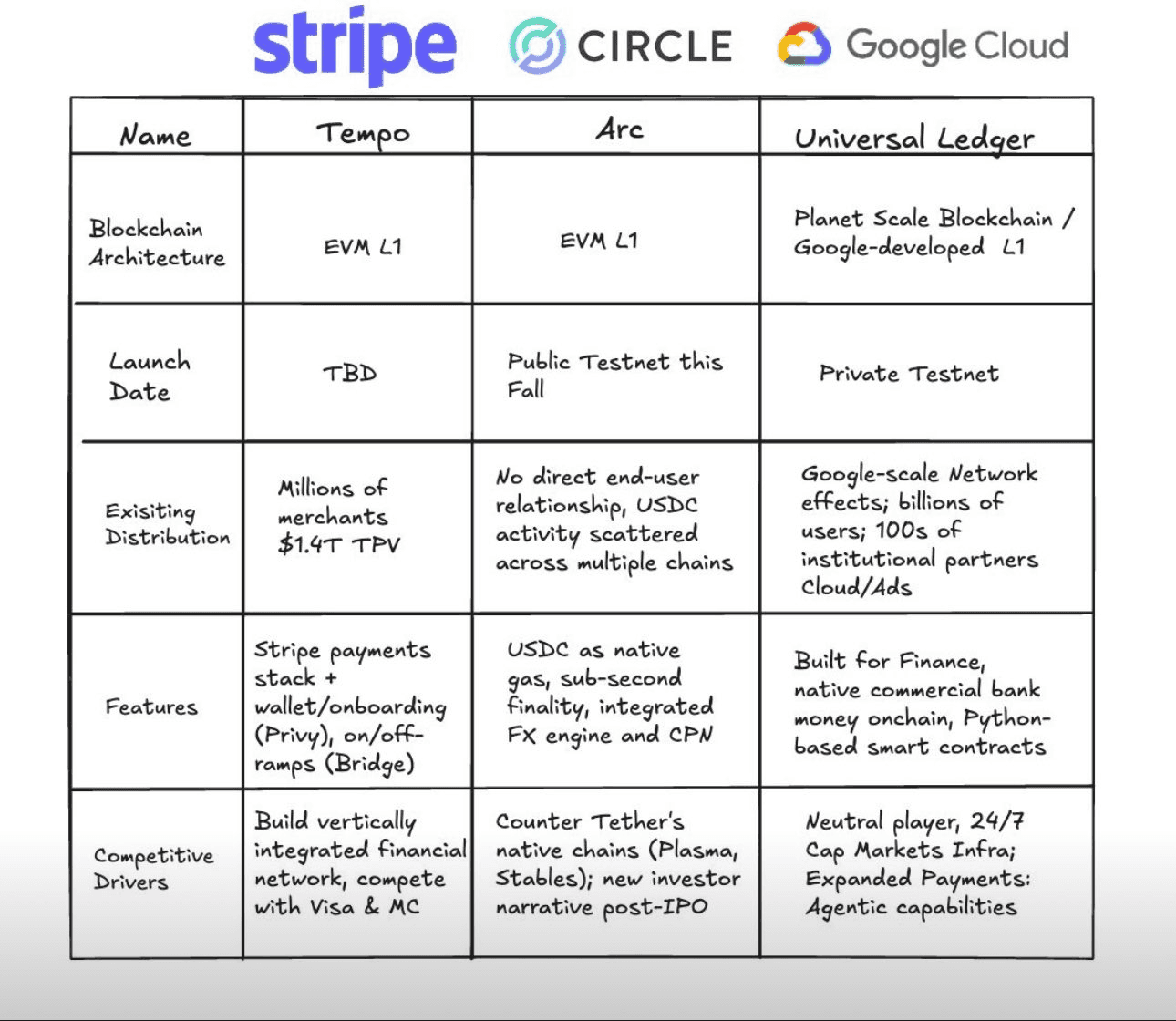

Big players in fintech – Circle, Stripe, and now Google – are launching their own Layer 1 (L1) blockchains. Their approach is to bypass public-chain bottlenecks and deliver near-instant, predictable fee structures. It’s a strategic shift signalling that other Web3 organizations must evolve, or they risk being overshadowed.

Fintech Giants Are Entering the Blockchain Race

Circle: Arc – Stablecoin-centric L1

Circle unveiled Arc, an EVM-compatible L1 purpose-built for stablecoin finance, integrating features such as USDC as its native gas token, sub-second settlement, an FX engine, and optional privacy controls. Public testnet is expected to launch in fall 2025, with full deployment by the end of the year.

Stripe: Tempo – Payments-powered L1

Stripe recently launched Tempo, a high-performance L1 built in partnership with Paradigm. This blockchain is designed to be Ethereum-compatible, targeting faster and cheaper stablecoin payment solutions.

Google: GCUL – Neural enterprise-grade L1

Google Cloud is advancing a Universal Ledger known as GCUL – a neutral, Python-based Layer 1 for finance. A pilot with the CME Group is already underway, with broader trials expected before launching in 2026.

Source: X (note that Tempo launched on September 4, 2025)

Spotlight: Japan-Based Layer 1s

Japan Smart Chain (JSC) — Japan’s sovereign Ethereum-equivalent L1

Japan Smart Chain, developed by AltX Research with technical support from Curvegrid, is validated onshore in Japan by Japanese industrial leaders, and optimized for Japanese regulations and consumer protections. JSC’s Mizuhiki Protocol is designed to streamline eKYC/AML processes, with the testnet launched in August 2025 and a mainnet rollout planned for 2026.

Japan Open Chain (JOC) – EVM-compatible Proof of Authority L1

Japan Open Chain operates on a Proof of Authority (PoA) consensus and is backed by major Japanese entities as validators, focusing on legally compliant infrastructure.

Astar Network, Oasys – Identity, gaming

These Layer 1 blockchains are helping shape Japan’s domestic Web3 ecosystem, each driving innovation across key areas such as digital identity and gaming.

Why Fintechs Are Choosing L1s Over L2s

Full Control and Performance: Owning the entire stack gives these large organizations more control over their infrastructure’s performance, costs, business strategy, consensus mechanisms, and governance.

Compliance and Customization: Developing an L1 allows for tighter regulatory alignment and specialized features that L2s may struggle to offer seamlessly.

The Bar is Raising for Web3 Organizations

The Web3 space is no longer competing only with crypto-native startups, as fintech giants with deep resources, regulatory clarity, and mainstream reach are entering the space. To survive and thrive, these companies must raise their standards across four fronts:

Security & Compliance

Security is now the baseline, not a differentiator. Formal verification, fraud detection, and robust audits are mandatory.

Compliance (KYC/AML, transaction monitoring) is becoming embedded at the protocol level, like with JSC’s Mizuhiki Protocol.

Scalability & Infrastructure

User Experience

Mainstream adoption depends on making blockchain "invisible" with fast, intuitive, and seamless integration with existing financial tools.

Seamless fiat-to-crypto bridges and low-friction onboarding are critical for attracting the next wave of users.

Strategy & Differentiation

The focus is shifting from just building "plumbing" to delivering unique products and user value.

Collaboration, transparency, and community trust will separate lasting protocols from those left behind.

Key Takeaways

The future of blockchain isn’t about who can build the most intricate smart contract from scratch. It’s about who can deliver real-world value, at scale, with trust and efficiency that can match enterprise-grade security and compliance. The ultimate victory is making blockchain so seamless and trusted that nobody even notices it’s there; users only see the value, not the complexity beneath the surface.

Are you ready to accelerate your Web3 strategy and focus on what truly sets your brand apart?

Don’t just keep up with the fintech giants, out-innovate them. If you’re an enterprise looking to launch or scale your business, we can help. From protocol design to blockchain integration, our team delivers end-to-end development that meets enterprise-grade security, compliance, and performance standards.

Your edge starts here. Talk to our team at sales@curvegrid.com.